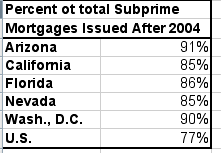

Subprime mortgages took off after 2004. Subprime mortgages had been around for a long time. But their popularity took off in late 2004. Most subprime mortgages were issued after 2004, according to a survey by the New York Federal Reserve.

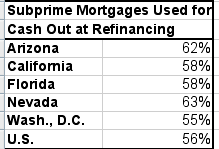

Subprime mortgages were not used primarily for new home purchases.

One of the familiar media narratives is that subprime loans were used as part of a government policy to make home ownership affordable to low-income people. But in fact most subprime loans were used to refinance existing mortgages, and not for new home purchases. And most of those refinancings were also used by home owners to take out more cash from their home equity.

Many people who would have qualified for a traditional prime mortgage took out a subprime mortgage instead, based on the recommendation of mortgage brokers, who earned bigger upfront fees from the subprime product.

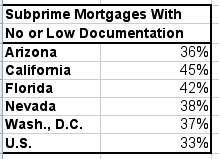

A big percentage of subprime mortgages had inadequate documentation. It's easy to engage in mortgage fraud if you don't need to prove your income or your net worth. And the proliferation of "no income, no asset" mortgage loans did just that. It was an invitation to fraud. This product was most popular in California and Florida.

Most subprime mortgages had adjustable rates. Most subprime mortgages had low introductory interest rates that reset after a few years. Often, when the rates were reset, homeowners discovered they were no longer able to afford the monthly payments.

Subprime Mortgages With

Adjustable Interest Rates

Arizona 73%

California 69%

Florida 65%

Nevada 68%

Wash., D.C. 68%

U.S. 61%

0 comments:

Post a Comment